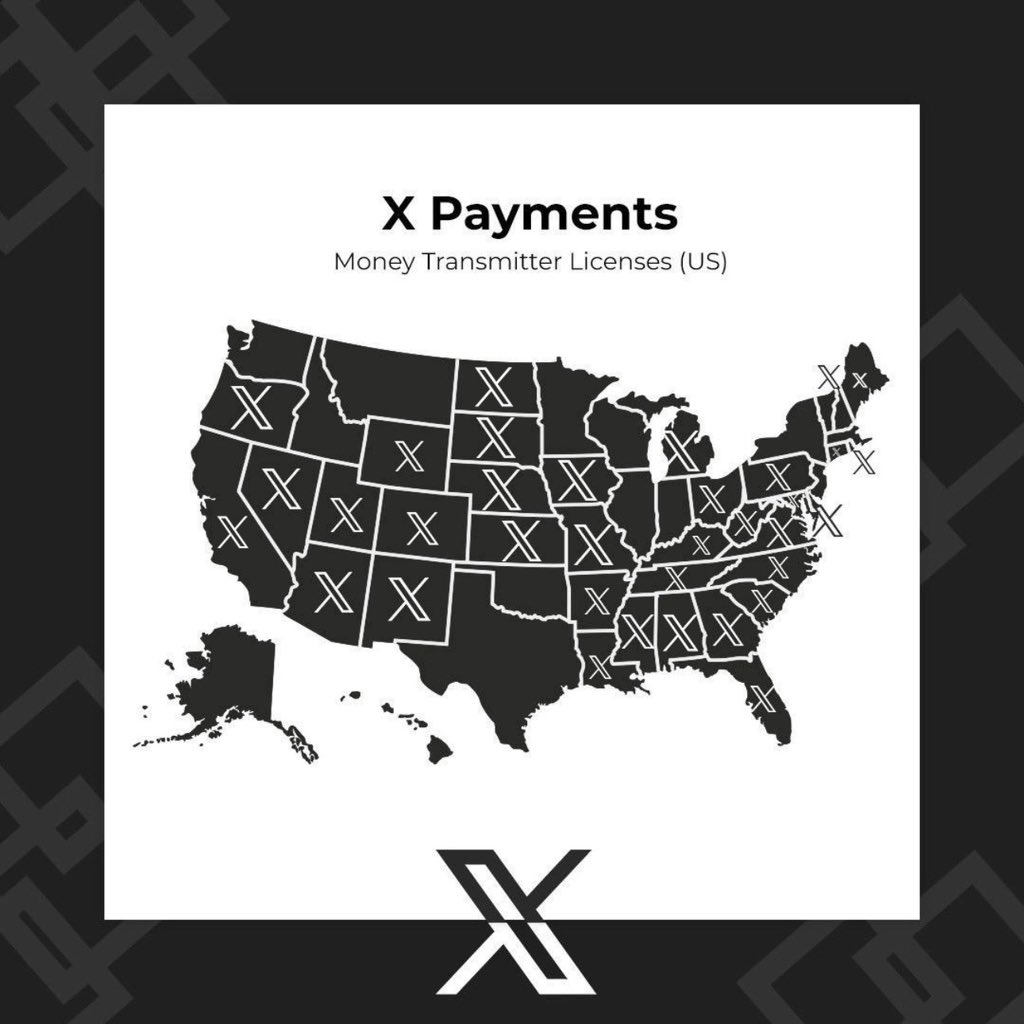

In a world where social media and financial services are becoming increasingly intertwined, 𝕏 is at the forefront of this revolution. Recently, 𝕏 secured the Money Transmitter License in Maine, bringing its total number of licensed states to 36. This move signifies a crucial step in 𝕏’s ambition to integrate finance seamlessly into its social media platform, potentially reshaping how users interact, transact, and engage with content online.

𝕏 Payments: Expanding Its Reach Across the U.S.

A Growing Network of Licensed States

As of now, 𝕏 Payments holds Money Transmitter Licenses in 36 states across the U.S., marking significant progress in its mission to build a robust financial network. The licenses allow 𝕏 to offer a variety of payment services, including money transfers, digital wallets, and potentially cryptocurrency transactions, which positions the platform as a major player in the fintech space.

States Where Approval Is Still Pending:

- West Coast:

- Hawaii

- Mountain States:

- New Mexico

- Midwest:

- Iowa

- Missouri

- South:

- Kentucky

- West Virginia

- East Coast:

- Delaware

- Vermont

- Rhode Island

- Connecticut

- Massachusetts

- New Hampshire

- Maryland

These states represent the remaining regions where 𝕏 Payments has yet to obtain its Money Transmitter License, which are essential for expanding its financial services across the entire United States.

States Where 𝕏 Is Licensed

Here is a list of the states where 𝕏 has secured Money Transmitter Licenses, as depicted in the image:

𝕏 now has licenses in 36 states: Alabama, Arizona, Arkansas, California, Colorado, Connecticut, District of Columbia, Florida, Georgia, Illinois, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Michigan, Mississippi, Missouri, Nebraska, Nevada, New Hampshire, New Mexico, North Carolina, North Dakota, Ohio, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Utah, Virginia, West Virginia, Wyoming.

This extensive list highlights 𝕏’s rapid expansion and strategic acquisition of licenses, enabling the platform to operate legally and effectively across the majority of the United States.

Potential for Dogecoin Integration

A Leap Towards Cryptocurrency Adoption

One of the most exciting prospects for 𝕏 Payments is the potential integration of Dogecoin, a cryptocurrency that has gained significant popularity, particularly among younger demographics and tech enthusiasts. This move would not only bolster 𝕏’s position in the crypto space but also cater to a growing segment of users who are looking for more flexible and decentralized payment options.

What Dogecoin Integration Could Mean for Users

Integrating Dogecoin into 𝕏 Payments could transform how users transact on the platform. For instance:

- Instantaneous Transactions: Cryptocurrency transactions, including Dogecoin, can be processed almost instantaneously, reducing the lag associated with traditional payment methods.

- Lower Transaction Fees: Cryptocurrencies generally have lower transaction fees compared to traditional banking systems, making it more cost-effective for users.

- Global Accessibility: Dogecoin, like other cryptocurrencies, is not tied to any particular country, allowing for seamless global transactions without the need for currency conversions.

- Anonymity and Privacy: Cryptocurrencies offer enhanced privacy features, which could appeal to users who are concerned about data security and privacy in online transactions.

Challenges and Considerations

While the integration of Dogecoin presents numerous advantages, it also comes with challenges:

- Regulatory Hurdles: Cryptocurrencies are subject to varying regulations across different states and countries, which could complicate their integration into 𝕏 Payments.

- Volatility: The value of Dogecoin, like other cryptocurrencies, can be highly volatile, which could pose risks for users and the platform itself.

- Adoption Rates: While popular, Dogecoin’s adoption rates are still limited compared to more established payment methods. 𝕏 would need to ensure sufficient infrastructure and user education to support widespread adoption.

Competing with PayPal: The Road Ahead

𝕏 Payments vs. PayPal: A New Challenger?

With its expanding network of Money Transmitter Licenses and potential cryptocurrency integration, 𝕏 Payments is poised to challenge established players like PayPal in the digital payment space. Here’s how 𝕏 could position itself as a formidable competitor:

Advantages of 𝕏 Payments

- Integrated Social Platform: Unlike PayPal, which is primarily a standalone payment service, 𝕏 Payments is deeply integrated into a social media platform, allowing users to transact within the same ecosystem where they engage with content, communicate, and build communities.

- Innovative Payment Solutions: 𝕏’s focus on innovation, including potential Dogecoin integration and other crypto-friendly services, could attract users who are looking for cutting-edge payment solutions.

- Lower Fees: If 𝕏 can leverage its platform to offer lower transaction fees, it could draw users away from PayPal, which has faced criticism for its fee structure.

Challenges in Competing with PayPal

- Established User Base: PayPal has a massive and loyal user base, built over decades of operation. Convincing these users to switch to 𝕏 Payments could be challenging.

- Brand Trust: PayPal is a well-established brand with a reputation for reliability and security. 𝕏 will need to build a similar level of trust, particularly as it ventures into new and uncharted territories like cryptocurrency integration.

- Global Reach: PayPal operates in over 200 countries and supports multiple currencies. 𝕏 would need to expand its licensing and operational reach significantly to compete on this level.

Future Prospects: The Evolution of 𝕏 Payments

Expanding Beyond the U.S.

While 𝕏 Payments is currently focused on expanding its presence across the U.S., its long-term vision likely includes global expansion. Securing international Money Transmitter Licenses would enable 𝕏 to offer its services worldwide, further integrating social media and finance on a global scale.

Integration with E-commerce

Another potential growth area for 𝕏 Payments is e-commerce. By enabling businesses to accept payments directly through 𝕏, the platform could become a powerful tool for online retailers, particularly those targeting younger, tech-savvy consumers who are already active on social media.

Leveraging Data for Financial Innovation

𝕏’s vast amount of user data could be leveraged to offer personalized financial services, such as microloans, tailored investment advice, and other fintech solutions. By analyzing user behavior and preferences, 𝕏 could create a more personalized and user-centric financial experience.

Conclusion

𝕏 Payments is rapidly emerging as a major player in the fintech industry, with its recent acquisition of Money Transmitter Licenses across 36 states marking a significant milestone. The potential integration of Dogecoin and the platform’s growing capabilities position it as a serious competitor to established payment giants like PayPal. As 𝕏 continues to expand its financial services, it is not just reshaping the landscape of digital payments but also redefining the intersection of social media and finance.

In the coming years, 𝕏 Payments could very well become a household name in the world of finance, offering innovative, user-friendly, and globally accessible financial solutions.