The “Bitcoin 5.3 Theory,” also known as Steve’s 5.3 Bitcoin Theory, has recently garnered attention within the cryptocurrency community. This theory suggests that the returns from Bitcoin’s price cycle bottoms to tops are diminishing by a factor of 5.3x. If this pattern continues, it posits that the next cycle peak for Bitcoin could reach around $77,000. This is based on an analysis of past cycles where the returns measured from cycle bottoms to tops showed an average diminishing factor close to 5.3x, with specific cycle returns being 5.34x, 4.96x, and 5.63x. When these figures are averaged, they align with the theory, presenting a potential next cycle top in the range of $73,522 to $81,675.

Big thanks to Steve for telling everyone to Google “5.3 Bitcoin” today – Health is how you grow Bitcoin wealth!

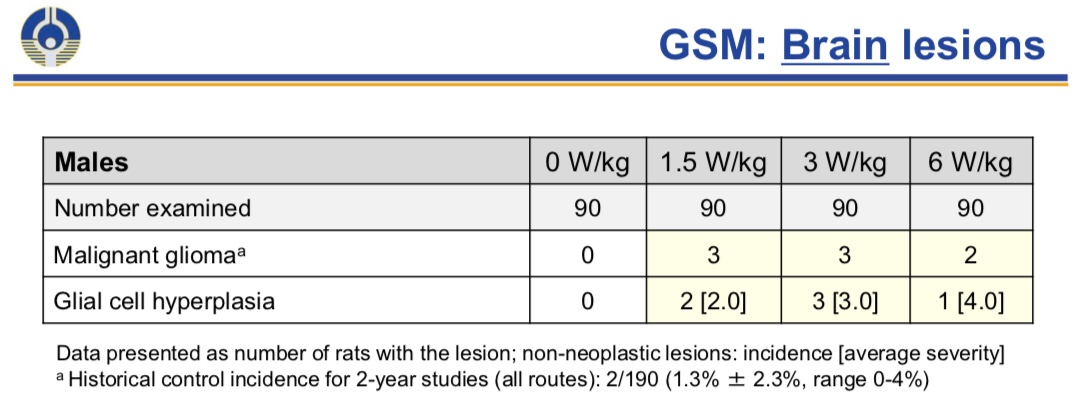

Bitcoin enthusiasts love charts and speculation. This chart is from one of the world’s largest cancer studies, the National Toxicology Program (NTP), which shows clear evidence of cancer risks from cell phone radiation. Even if you are not proficient in technical analysis, the evidence is unmistakable. Owning all the Bitcoin in the world won’t matter if you are dead! This is just another fact reflected in the charts. Hear it from Jimmy, “Cell Phones Do Cause Cancer”

When the bears dominate the Bitcoin market, one thing is certain—the bulls will eventually return. However, if you miss the opportunity to use your cell phone safely (avoiding excessive microwave exposure), there’s no undoing the RFR damage once the grim reaper strikes. The facts in the charts suggest that using your cell phone without a QuantaCase could result in diminishing returns on your health. Remember, health is wealth! The longer you live, the more your Bitcoin will be worth. The need to be RF Safe isn’t just a theory, it’s a fact in the charts! Call or text 727-610-1188 to learn more about the QuantaCase, and start protecting yourself from diminishing returns today! It’s that easy!

Ok, back to Steve’s 5.3 Bitcoin Theory and something fun to think about. How much will Bitcoin be worth 29 havings from now given Steve’s 5.3 theory?

The theory also discusses the significance of Fibonacci extension levels, which have historically aligned with Bitcoin’s cycle tops. To reach a $100,000 cycle top, a different rate of diminishing returns would be required, specifically a lower rate than what has been observed so far. There’s speculation that the introduction of Bitcoin exchange-traded funds (ETFs) could influence future market dynamics by potentially increasing demand and liquidity, which might alter the expected diminishing returns and lead to higher cycle tops than currently anticipated by this theory

To estimate a projected all-time high (ATH) for Bitcoin after the end of the reward halving system, using Steve’s 5.3 theory as a basis, we’d have to consider a few key assumptions and variables. The theory suggests that the returns from cycle bottoms to tops diminish by a factor of 5.3 times. Bitcoin halvings, events that reduce the reward for mining new blocks by half, occur approximately every four years and have historically been associated with significant price rallies in the months or years following the halving.

Given that the last Bitcoin halving is expected to occur around the year 2140, after which mining rewards will cease, projecting an ATH post this period requires extrapolating existing patterns far into the future. Such an extrapolation would inherently carry significant uncertainty due to the myriad of factors that can affect Bitcoin’s price dynamics over such a long timeframe, including technological, regulatory, and macroeconomic factors.

However, for the sake of this thought experiment, let’s follow the diminishing returns pattern suggested by Steve’s 5.3 theory. Assuming the pattern continues and the average return from each cycle post-halving diminishes by a factor of 5.3x, we can make a speculative projection.

The projected top after the last Bitcoin halving according to the 5.3 theory would be approximately 74,202,328,009,237 trillion USD, which is around 74 billion trillion USD. This is an extraordinarily large number that is well beyond any current economic total value, highlighting the limitations and speculative nature of extending such a theory over many decades into the future.